B.Com 4 Semester

Advance Accounting

Paper-BCM-402

Time Allowed: Three Hours] [Maximum Marks: 80

Note: Attempt any four questions from Section A each carries 5 marks. Attempt any two questions each from Sections B and C each carries 15 marks.

SECTION-A

I. On 1st April, 2012 Mr. Gupta brought 3 trucks on his purchase system and paid 3 equal installments of Rs. 30,000 each on 31-3-13, 2014 and 2015. The cash price of the trucks was Rs. 81,700. The vendor charged interest @ 5% p.a. Make a table showing interest to be charged with each instalment.

II. A fire occurred in the premesis of X on 25-8-2014 when a large part of the stock was destroyed. Salvage value was Rs. 15,000. Following additional information is available:

(a) Purchases Rs. 85,000

(b) Sales Rs. 90,000

(c) Goods costing Rs. 5000 were taken by X for personal use.

(d) Cost Price of stock on January 2014 was Rs. 40,000. Over the part few years, X has been selling goods at a gross profit of 33-1/3%. The Insurance policy was Rs. 50,000. It included an average clause. X asks you to prepare a statement showing the claims to be made to the Insurance Company.

III. From the following balance sheet, prepare a Consolidated Balance Sheet:

IV. Write a note on Yield Method of valuation of shares.

V. What are different methods of calculating Purchase Consideration?

VI. Write a short note on Minority Interest.

SECTION-B

VII. What do you understand by Hire Purchases System? Give the journal entries to be passed in the books of hire purchaser and vendor.

VIII. What do you understand by Consequential Loss Policy? Explain the procedure for the calculation of claim under such policy explaining the related terms.

IX. Following information is presented by Mr. Z, relating to his holding in 9% Central Government Bonds:

Opening balance (face value) Rs. 1,20,000, Cost Rs. 1,18,000 (face value of each unit is Rs. 100):

1-3-2015 Purchased 200 units, ex-interest at Rs. 98.

1-7-2015 Sold 500 units, ex-interest out of original holding at Rs. 100.

1-10-2015 Purchased 150 units at Rs. 98, cum-interest.

1-11-2015 Sold 300 units, ex-interest at Rs. 99 out of original holdings.

Interest dates are 30th September and 31st March. Mr. Z closes his books every 31st December. Show the investment account as it would appear in his books.

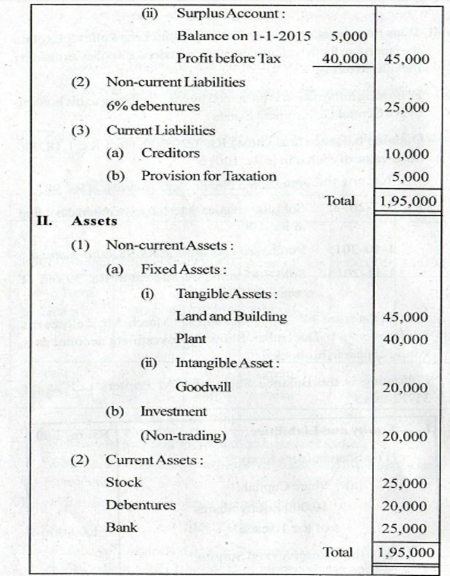

X. Following is the Balance Sheet of ICM Printers Ltd. as on 31-12-2015:

The assets were revalued as under :

Plant Rs. 50,000, Land and Building Rs. 40,000, Investment Rs. 25,000, Profit includes Rs. 1,000 income from investment.

Calculate the value of goodwill on the basis of three year's purchase of super profit. Normal rate of return in this type of business is 12%. Tax rate is 50%. Depreciation on Plant is at 5% and on Building it is at 10%.

SECTION-C

XI. Define Holding Company. State the conditions under which a company can become the subsidiary of another company.

XII. Prepare Liquidators Final Statement of Accounts and Sufficiency/Surplus Account with imaginary figure.

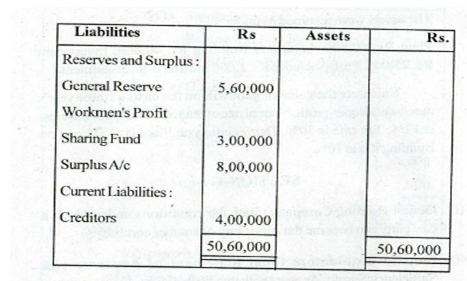

XIII. Following is liabilities and assets of Y Ltd. as at 31st March 2015:

X Ltd. decided to absorb the business of Y Ltd. at the respective book valued of assets and trade liabilities except building which was valued at Rs. 12,00,000 and plant and machinery at Rs. 10,00,000.

The purchase consideration was payable as follows:

(i) Payment of Liquidation expenses Rs 5,000 and workmen's profit sharing fund at 10% premium;

(ii) Issue of equity shares of Rs. 100 each fully paid at Rs. 11 per share for every preference share and every equity share of Y Ltd. and a payment of Rs. 4 per equity share in cash.

Calculate the purchase consideration, show the necessary ledger accounts the books of Y Ltd. and opening journal entries in the books of X Ltd.

XIV. Balance Sheet of Nipun Ltd. on 31st March, 2015 was follows:

The capital reduction scheme, approved by the court is as under:

(i) Holders of 6% debentures of Rs 100 each are to be given 8% debentures of Rs. 50 and preference shares of Rs. 10 each of equal amount, for the remaining amount of Rs. 50.

(ii) The value of all preference shares including the preference shares given in debenture-holders as shown above, is to be reduced to Rs. 6 and dividend rate is to be increased upto 9%.

(ii) The value of equity shares is to be reduced to Rs. 2.

(iv) The existing equity shareholders are to purchase additional equity shares of Rs. 1,00,000 for cash, to pay off the bank overdraft.

(v) All fictitious and intangible assets are to be written off. Machinery and furniture are to be written off in proportion of book values, with the help of General Reserve and Capital Reduction A/c.

Pass necessary Journal Entries in the books of the company to record the above transactions. Prepare the company's Balance Sheet after such changes.

0 comments:

Post a Comment

North India Campus