B.Com 4th Semester

Cost Management

Paper-BCM-404

Time Allowed: Three Hours] [Maximum Marks: 80

Note:- There are three Sections A, B & C. Attempt any four questions from Section A, each carry 5 marks. Attempt two questions each from Section B and C, each carry 15. marks.

SECTION-A

Attempt any four questions.

I. Different areas of Cost Management.

II. What is Uniform Costing?

III. What is Target Costing?

IV. Compute Economic Batch quantity for a company using Batch Costing with the help of the following information:

Annual Demand for the parts 4000 Unit

Setting up Cost Rs. 100

Cost of Manufacturing Amount Rs. 200

Rate of Interest per annum 10%

V. XYZ Ltd. has prepared the budgets for the production of one lakh units of the only. Commodity manufactured by them for a costing period as under :

(Rs. Lakh)

Raw Material 2.52 Works OH (60% fixed) 2.25

Direct Labour 0.75 Ad OH (80% fixed) 0.40

Direct expenses 0.30 Selling OH (50% fixed) 0.20

The actual production during the period was only 80,000 units. Calculate the revised budgeted cost per unit.

VI. A Company has a capacity of producing 5,00,000 units of a certain product per annum. The sales department reports that the following prices are possible at various levels of production :

The volume of production Selling Price Per Unit Rs.

60% 2.00

70% 1.80

80% 1.60

90% 1.40

100% 1.25

The Variable Cost of manufacturing between these levels is Rs. 0.40 per unit and Fixed Cost Rs. 4,00,000. Prepare a statement showing incremental revenue and differential cost at each stage. At which volume of production will the profit be maximum?

SECTION-B

Attempt any two questions.

VII. Define Cost Management. Also, explain the need and importance of Cost Management in today's environment.

VIII. What do you understand by Activity Based Costing? Explain the basic elements and state the advantages of Activity Based Costing.

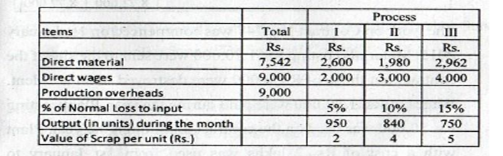

IX. Product 'Z' is obtained after it passes three distinct processes. The following information is obtained from the accounts for the month ending March 2016:

1000 units at Rs. 3 each were introduced to process I. There was no stock of material or work-in-progress at the beginning or end of the period. The output of each process passes direct to the next process and finally to finished stores. Production overhead is recovered on 100 percent of direct wages.

Prepare process Cost Accounts and other related accounts.

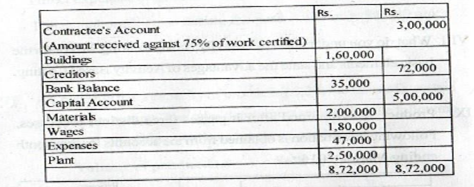

X. Following is the Trial Balance of Premier Construction Company, engaged on the execution of Contract No. 747, for the year ended 31st December 2015 :

The work on Contract No. 747 was commenced on 1st January 2015. Materials costing Rs. 1,70,000 were sent to the site of the contract but those of Rs. 6,000 were destroyed in an accident. Wages of Rs. 1,80,000 were paid during the year. Plant costing Rs. 50,000 was used on the contract all through the year. Plant with a cost of Rs. 2 lakhs was used from 1st January to 30th September and was then returned to the stores. Materials cost of Rs. 4,000 were at the site on 31st December 2015.

The contract was for Rs. 6,00,000 and the contractee pays 75% of the work certified. Work certified was 80% of the total contract work at the end of 2010. Uncertified work was estimated at Rs. 15,000 on 31st December 2015.

Expenses are charged to the contract at 25% of wages. The plant is to be depreciated at 10% for the entire year.

Prepare Contract No. 747 Account for the year 2015 and make out the Balance Sheet as on 31st December 2015 in the books of Premier Construction Co.

SECTION-C

Attempt any two questions.

XI. What is Budgetary Control? State main objectives of Budgetary Control. What are the main steps in establishing a Budgeting Control?

XII. Explain the Differential Costing as a tool for decision-making. State the major applications of Differential Costing.

XIII. The Standard Cost of a chemical mixture is as under:

4 Tons of material A at Rs. 20 per Ton

6 Tons of material B at Rs. 30 per Ton box

Standard yield is 90 per unit of input 922021

Actual cost for a period is as under

4.5 Tons of material A at Rs. 15 per Ton

5.5 Tons of material B at Rs. 34 per Ton

Actual yield is 9.1 Tons

Compute all material variances.

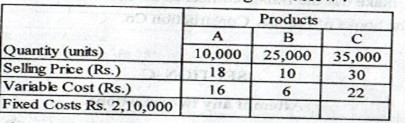

XIV. The Sunline Company manufactures and sells three products, A, B, and C. The data for them are given below:

Fixed Costs Rs. 2,10,000 Fixed costs are allocated on the basis of the number of units produced. The plant, if currently fully utilised, each unit requires same manufacturing time.

Product A is unprofitable and Sales Manager is in favour of dropping it. The loss per unit of product is calculated as follows by the accountant :

Rs. Rs.

Less: Selling Price per unit 18

Variable Cost per unit 16

Fixed Cost per unit -3 19

Loss per units 1

The Fixed Cost per unit is found as : Rs. 2,10,000+ 70,000 units of A, B and C.

Required:

(i) Should Product Abe dropped assuming that there does not exist any use of capacity.

(ii) Should Product A be dropped if more units of Product B could be sold?

(ii) What should be the selling price of Product A to make it as profitable as Product B?

0 comments:

Post a Comment

North India Campus