BBA-Bachelor of Business Administration 2nd Semester

Financial Management

Paper-BBAS126

Time Allowed: Three Hours] [Maximum Marks: 80

Note:- Attempt any four short answer-type questions from Section-A. Attempt any two questions each from Section-B and Section-C respectively.

SECTION-A

1. (a) Write a note on Profit Maximization and Wealth Maximization.

(b) What is Capital Budgeting?

(c) Mr. X deposits Rs. 5,000 at the end of every year for 5 years and deposits earn compound interest at 8% p.a. Determine how much money he will have at the end of 5 years.

(d) The market price of equity share of a company is Rs. 135 each. Its expected dividend per share next year is Rs. 18 and expected to grow at 6% per year. Determine the cost of equity share.

(e) A company has sales of Rs. 5,00,000, variable cost of Rs. 3,00,000, fixed cost of Rs. 1,00,000 and long term loans of Rs. 5,00,000 @ 10% rate of interest. Calculate the composite leverage.

(f) What do you mean by trade credit?

SECTION-B

2. What do you mean by financial management? What should be its basic objective in a corporate enterprise?

3. Explain any two methods of capital budgeting.

4. A company is considering a proposal to purchase a new machine with initial cash outlay of Rs. 5,00,000 and working capital of Rs. 60,000. The expected life of machine is 5 years with no salvage value. The company uses straight line method of charging depreciation. The estiminated cash flows before depreciation and taxes are given below :

Calculate (a) Payback period (b) Net Present Value (c) Average rate of return if the applicable income tax rate to the company is 35% and the opportunity cost of Capital of the company is 10%. You may use the following table :

Year: 1 2 3 4 5

P.V. Factor @ 10% 0.909 826 751 683 .621

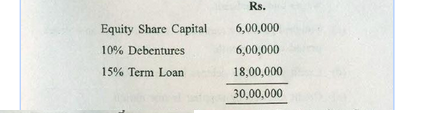

5. The following information has been taken from the Balance Sheet of a firm as of 31-12-2017 :

Determine the weighted average cost of capital of the firm. It had been paying dividends at a constant rate of 20% per annum.

SECTION-C

6. Explain in detail relevance concept of dividend policy or the theory of relevance.

7. Briefly discuss long term and short term source of company finance.

8. Estimate the working capital requirement of a company which maintains level of activity of 2,00,000 units at selling price Rs: 12/per unit from the following particulars :

Element of Cost :

Material 40%

Direct Labour 20%

Overhead 20%

Further Information :

(a) Raw materials are expected to remain in stock for an average of one month.

(b) Material will be in progress on average half a month and is assumed to be consisting of 100% of raw material, wages, and overheads.

(c) Finished goods are required to be in stock for an average period of one month.

(d) Credit allowed to debtors is two months.

(e) Credit allowed by the supplier is one month.

Assume that sales and production pattern is even throughout the year

9. (a) A company expects a net income of Rs. 80,000. It has Rs. 2,00,000, 8% debentures. The equity capitalisation rate of company is 10%. Calculate the value of the firm and overall capitalisation rate according to Net Income Approach (ignoring income tax).

(b) If the debenture debt is increased to Rs. 3,00,000, what shall be the value of the firm and overall capitalisation rate ?

0 comments:

Post a Comment

North India Campus