B. Com. - Bachelor of Commerce 5th Semester

Income Tax Law

BCM-501

Max. Marks: 80] [ Time allowed: 3 Hours

NOTE: Attempt four short answer type questions from Section-A carries 5 marks each. Attempt two questions each from Section B and C respectively carries 15 mark each.

Section - A

1. Explain the instances in brief where income of previous year is assessed in the same year.

2. The business of an HUF is operated from Norway and all the policy decisions are taken from there. Mrs Promila, the Karta of the HUF, who was born in Chandigarh, visits India during the previous year after 11 years. She comes to India on 12.04.2020 and leaves for Norway on 12.12.2021. During her stay in India, she received an income of Rs. 222,000 on behalf of HUF business, Determine the residential status of Mrs. Promila, taxability status of income received and residential status of HUF for the Assessment year 2021-22.

3. State whether the following are chargeable to tax with support from Income tax laws for the previous year 2020-21:

a. Rent of Rs. 86,000 received for letting out agricultural land for a movie shooting.

b. Agricultural income to a resident of India from a land owned in Canada worth Rs. 28,000.

c. A political party registered u/s 29A of the relevant act earned rental income of Rs. 731,000 by letting out its premises and the accounts are properly maintained by party in this regard.

4. Dr. Mohindroo, a first-generation entrepreneur engaged in manufacturing business, furnishes the following details:

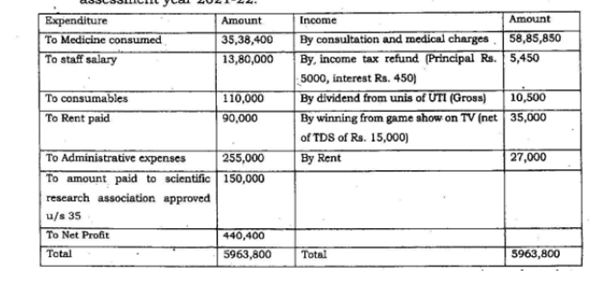

a. Opening WDV of Plant and Machinery as on

01.04.2020 30,00,000

b. New Plant and Machinery purchased and put to use on

08.06.2020 20,00,000,

New Plant and Machinery acquired and put to use on

15.12.2020 8,00,000

d. Computer acquired and installed in the office premises on

02.01.2021 3,00,000

Compute the amount of depreciation and additional depreciation as per Income tax act for the assessment year 2021-22 with the assumption that all payments were made through cheque only.

5. Dr Sureet converts his plot of land purchased in 01 July, 2003 for Rs. 80,000 into stock in trade on 31st March, 2020. The fair market value as on 31st March, 2020 was Rs. 300,000. The stock in trade was sold for Rs. 325,000 in the month of 1st January 2021. Find out the taxable income, if any, and if so under which head of income and for which assessment year? Cost Inflation index FY 2003-04- 109; FY 2019-20-289.

6. State the taxability instances when gifts received by a person included in his income in case of monetary gifts and immovable property gifts.

Section - B

7. How does the tax liability of a not ordinarily resident person differ from that of a resident and ordinarily resident person under the Income tax act? Explain with a hypothetical example.

8. Explain:

a. Integration of agricultural income in total income with a hypothetical example.

b. Enumerate any six types of Incomes u/s 10.

9. Dr. Kapila Bhagirathi is an employee of ENJY ltd. He was appointed on 1st March, 2020 at the scale of 50,000-5000-70,000. He was paid dearness allowances forming part of retirement benefits also @ 15% of basic pay and bonus equivalent to 2 months' salary at the end of financial year. He contributes 18% of his basic pay plus DA to a recognized provident fund, and the contribution is matched by the employer. He is provided rent free accommodation, hired by the employer @25,000 per month. He is also provided with the following amenities:

a. Lunch during office hours valued at Rs. 2200/-.

b. Motor car owned and driven by him with engine capacity within 1.6 L was used partly for official and partly for personal purposes. Its running and maintenance expenses are borne by employer worth Rs. 36,600/-.

c. Medical insurance for him was paid by his employer Rs. 15,000.

d. Gift voucher of Rs. 4,500 on account of his birthday was given. e. He has been provided with mobile and internet allowance @1200 per month.

f. His housekeeper was paid a monthly salary of Rs. 4000 by the employer.

g. His dependent spouse was provided with a medical treatment of worth Rs. 40,000.

h. Allotment of sweat equity shares totalling 2000 shares were allotted to him @ 227 per share having a fair market value of Rs. 377 per share as on the date of exercise of the option.

Compute the salary chargeable to tax if Dr. Kapila is not willing to opt for section 115BAC for the assessment year 2021-22.

10. Mr Love and Ms Affection, brother and sister, are co-owners of a house property, with 50% share each in the property. The property was constructed before 1st April, 1999. The property has 7 equal units and is situated in Bangalore. During the financial year 2020-21, each co-owner occupied one unit each and the balance were let out @ a rental value of Rs. 20,000 per unit per month. The Muncipal valuation was Rs. 500,000 and the Municipal taxes were @10% of the municipal value. Interest payable on loan taken for construction was Rs. 400,000. One of the let- out unit was vacant for 6 months in the year. Compute the income from house property for each of co-owner for the assessment year 2021-22.

Section-C

11. Elaborate on the following with regard to Capital Gains:

a. State those instances where indexation of cost is not allowed for capital assets.

b. Exemptions available to an individual on transfer of a Capital Asset u/s 54.

12. Explain the following in case of profits and gains of business or profession:

a. Expenditure on family planning amongst employees b. Deemed profits chargeable to tax

c. Amortization of preliminary expenses u/s 35 D

13. From the Income and Expenditure account of Dr. Jyoti Madaan, a resident individual, aged 62 years who is running a clinic in Sangrur, for the year ending 31st March, 2021, find out her taxable income for the assessment year 2021-22:

14. In computing the income, the following facts are to be taken into consideration:

a) Clinic equipments are: 01.04.2020 Opening WDV Rs. 500,000

b) Acquired equipments by cheque on 07.12.2020 Rs. 200,000 c) Rent paid includes Rs. 30,000 paid by cheque towards rent for her residential house in Sangrur.

d) Dr. Madaan availed a loan of Rs. 550,000 from a bank for higher education of her daughter. She repaid principal of Rs. 100,000 and interest thereon Rs. 55,000 during the previous year 2020-21.

e) She paid Rs. 100,000 as tuition fee (not in the nature of development fees/donation) to the university for full time education of her daughter.

f) An amount of Rs. 28,000 has also been paid by cheque on 27th March, 2021 for her medical insurance premium.

From the above, compute the total income of Dr. Madaan for the assessment year 2021-22 under the provisions of the Income tax act 1961, assuming that she has not opted for to pay tax under section 115BAC.

Do as directed:

a. Mr. Deepak transferred his residential house to Mr. Kumar for Rs. 10,00,000 on 1st April, 2020. The value of the said house as per Stamp Valuation Authority was Rs. 16,00,000. Mr. Kumar is a childhood friend of Deepak. Mr. Deepak gifted a plot of land (purchased by him on 1st August, 2007) to Kumar on 1st July, 2020. The value as per Stamp Valuation Authority is Rs. 800,000. Mr. Kumar sold the plot of land on 1st March, 2021 at Rs. 14,00,000. Compute the income of Kumar chargeable under the heads Capital Gains and Income from other sources for the assessment year 2021- 22.

b. Calculate the total income from other resources for Ms Anshu, being a ordinarily resident, for the previous year 2020-21:

0 comments:

Post a Comment

North India Campus