B. Com. - Bachelor of Commerce 5th Semester

Management Accounting

BCM-502

Max. Marks: 80] [ Time allowed: 3 Hours

NOTE: Attempt four short answer type questions from Section-A carries 5 marks each. Attempt two questions each from Section B and C respectively carries 15 mark each.

Section - A

1. What do you mean by Comparative Financial Statements?

2. Define Social Accounting.

3. From the information given below, ascertain the cost of sales and closing inventory under CPP method, if LIFO is followed:

4. A firm has made credit sales of ₹2, 40,000 during the year. The outstanding amount of debt at the beginning and at the end of the year respectively was 27,500 and 32,500. Determine the debtor turnover ratio.

5. Calculate 'Funds from Operations' from the information given below as on 31st March 2014:

(a) Net Profit for the year ended 31 March 2014, 6, 50,000

(b) Gain on sale of building *35,500

(c) Goodwill appears in the books at 1, 80,000 out of which 10% has been written off during the year

(d) Old machinery worth 8,000 has been sold for ₹6,500 during the year

(e) *1, 25,000 have been transferred to the General Reserve Fund

(f) Depreciation has been provided during the year on machinery and furniture at 20% whose total cost is ₹6, 50,000

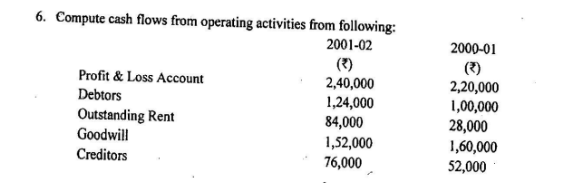

6. Compute cash flows from operating activities from following:

Section - B

7. Define Management Accounting. Explain the scope and importance of Management Accounting in modern digital economy.

8. What do you understand by the analysis and interpretation of financial statements? Explain any three methods used for the analysis and interpretation of financial statements.

9. The following information are given about X Ltd. for the year ending 31 March, 2008:

i. Stock turnover ratio = 6 times

ii. Gross Profit ratio = 20% on sales

iii. Sales for the year = ₹3,00,000

iv. Opening creditors = 20,000

v. Closing creditors ₹30,000

vi. Trade debtors at the end = *60,000

vii. Net working capital = *50,000

viii. Closing stock is ₹10,000 more than the opening stock.

(c) Creditors Turnover Ratio

(d) Average Payment Period.

10. Prepare a Common-Size Statement of Prof and Loss from the following information and interpret the same:

Section - C

11. "Responsibility accounting is an important device for control." Discuss.

12. Discuss the concept of Human Resource Accounting. Explain various methods for valuing human resource assets.

13. Following are the summarized balance sheets of X Ltd. As on 31st March, 2018 and 2019

Other information:

i. Dividend of 11,500 was paid.

ii. Assets of another company were purchased for a consideration of ₹30,000 payable in shares. The following assets were purchased: Stock -₹10,000; Machinery -12,500.

iii. Machinery was further purchased for ₹4,000.

iv. Depreciation written off machinery ₹6,000.

v. Income Tax provided during the year 16,500.

vi. Loss on sale of machinery 100 was written off to General Reserve.

You are required to prepare a Cash Flow Statement.

14. Following are the balance sheets of Y Ltd. as on 31st December 2018 and 2019

Additional information:

i. 10% Dividend was paid in cash.

ii. New machinery for ₹30,000 was purchased but old machinery costing ₹12,000 was sold for ₹.4,000, accumulated depreciation was ₹6,000.

iii. ₹20,000, 8% Debentures were redeemed by purchase from open market @96 for a debenture of ₹100.

iv. ₹36,000 Investment was sold at book value.

You are required to prepare a schedule of Changes in Working Capital and statement showing Sources and Application of Funds.

0 comments:

Post a Comment

North India Campus