BBA - Bachelor of Business Administration 3rd Semester

BBA-206: Direct Tax Laws

Exam.Code:0023

Sub. Code: 1958

Max. Marks: 80] [ Time allowed: 3 Hours

NOTE: Attempt four short answer type questions from Section-A. Attempt two questions each from Section B and C respectively.

Section - A

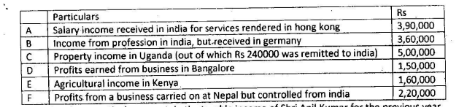

1. During the financial year 2019-20 Anil Kumar had the following incomes:

From the above particulars ascertain the taxable income of Shri Anil Kumar for the previous year 2019-20 if he is (i) resident and ordinarily resident (ii) not ordinarily resident (iii) non resident

2. R is employed as a pilot in air India. He is in receipt of the following during the previous year 2019-20:

1. Basic salary Rs 50000 p.m

2. Bonus is 2 months basic salary.

3. Entertainment allowance received Rs 11500 p.m

4. Uniform allowance received Rs 1200 p.m. He spends Rs 8000 for purchase and maintenance of uniform for official purposes.

5. He has been given Rs 6000 p.m as running allowance to meet personal expenses during the performance of his duties in transport.

Compute his income under the head salary for the assessment year 2020-21.

3. R purchased certain agricultural land in 2004-05 for Rs 8,00,000. The land was being used for agricultural purposes by him. This land is sold by him on 2.9.2019 for Rs 33,00,000. He has spent Rs 5,70,000 for acquiring an urban agricultural land on 21.10.2019 and has deposited Rs 6,00,000 under the capital gain deposit scheme on 15.04.2020. compute the taxable capital gain for assessment year 2020-21. CII for 2019-20= 289, for 2004-05-113.

4. Compute income from other sources of Ms. R from the following particulars:

5. Distinguish between short term capital asset and long term capital asset.

6. Write short note on annual value of house property.

Section - B

7. Shri Bharat is a purchase officer in a company in Jaipur. He furnished the following particulars regarding his income for previous year 2019-20.

1. Basic salary Rs 17,000 p.m.

2. Bonus Rs 5,000.

3. Dearness allowance Rs 3000 p.m.

4. Travelling allowance Rs 45,000. He spends Rs 30,000 for official purposes.

5. Reimbursement of medical bills Rs 25,000 (treatment was done in a government hospital in India).

6. He lived in a bungalow belonging to the company. Its fair rent is Rs 15000 p.m. the company has provided on this bungalow the facility of a watchman and a cook each of whom is being paid a salary of Rs 250 p.m. the company paid in respect of this bungalow Rs 5,000 for electric bills and Rs 3000 for water bills.

7. He has been provided with 1.5 ltr engine capacity car for official and personal use. The maintenance and running expenses of the car (including driver) are borne by the company.

8. The following amounts were deposited in his provident fund account;

i. Own contribution Rs 24,000

ii. Company's contribution Rs 30,000

iii. Interest @ 12%.p.a Rs 12600

9. Rent of house recovered from Bharat Rs 21600

Compute his taxable income from salary for the assessment year 2020-21. Assume the population of Jaipur is 26 lakhs as per 2001 census.

8. Mr. B owns a house property at Cochin. It contains of 3 independent equal units and information about the property is given below:

Unit 1: Own Residence, Unit-2: Let Out, Unit 3: Own Business

9. What do you mean by residential status? Explain how residential status of individual is determined.

10. Explain 15 exempted incomes under section 10 of Income Tax Act.

Section - C

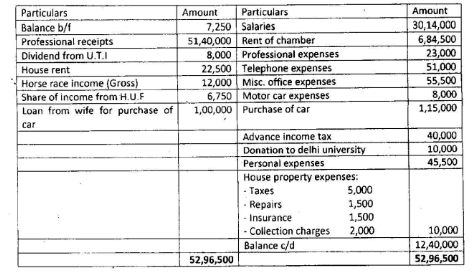

11. Shri Sanjeev is practicing as a chartered accountant in Delhi. He deposits all receipts in his bank account and pays all expenses by account payee cheque. Following is the analysis of his bank account for the year ending 31.3.2020:

Compute the gross total income of Shri Sanjeev after taking into account the following:

i. 1/4th of the motor car expenses relate to personal use.

ii. Car was purchased on 15.6.2019 and rate of depreciation on car is 15%.

iii. He stays in his house, the municipal value of which is Rs 8000. Following are the expenses which have been included in the above account in respect of this house: insurance premium Rs 500; municipal tax Rs 2400.

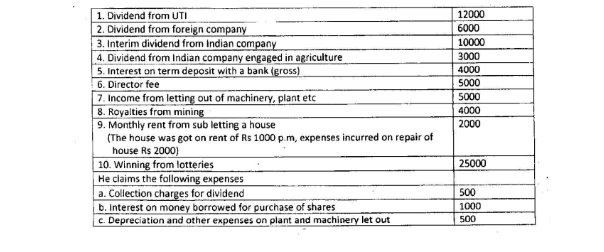

12. Mr. A furnishes the following particulars of his income, calculate his income from other sources:

13. Explain certain deduction in respect of payments under section 80.

14. What do you mean by capital gain? What are different types of capital gains? Explain how capital gain is computed.

0 comments:

Post a Comment

North India Campus